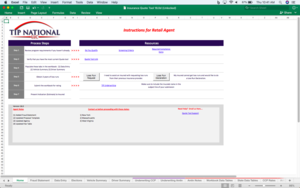

Overview

This webpage contains the steps needed to take an applicant from a submission to an insured customer. We have provided additional resources, links and documents to help provide a smooth transition.

Agency Resources & Program Details

We have assembled many of the resources you need to successfully implement the ClearCoverage Program and we strongly recommend every partner review this information – specifically the Program Highlights and Who We Are.

Click here for agency resources.

ClearConnect has developed an entire library of training materials to support our ClearTrac system. To access the documents, you can click the link below:

Phase 1: Initial Contact

Upon interaction with the potential insured, you will want to make sure to explain the ClearCoverage Program qualifications per the Underwriting Guidelines.

Key Note: The most effective model is “Self-Service”. You will want to let your customer know what will be expected of them through the ClearCoverage Program. Encouraging the customer to interact with the system to creates familiarity leading them to be more self-sufficient over the life of the relationship.

“Do I Qualify” Document: This single-page document is designed to be handed to the driver/contractors so they understand the insurance program qualifications. The questions here are specifically mapped to our underwriting criteria as well.

Phase 2: New Submissions

Estimates:

New submissions are as easy as 1-2-3:

- Collect applicant information and populate into the newest version of the TIP National Application (See new Submission Document).

- Submit TIP National Application via tipunderwriting@clearconnectsolutions.zendesk.com

- Your application will be rated and sent back once all underwriting information and documentation has been reviewed and accepted. The rated TIP National Application allows you to have a conversation about coverage’s and premiums with your potential insured.

Underwriting:

If the potential insured would like to move forward with coverage, the next step is to start the compliance process in ClearTrac. You will work alongside your assigned Business Advisor to collect all necessary compliance information and documents (refer to the “Required Compliance Items” document for a complete list). Once the applicant is fully compliant, they may continue to the bind process.

Quote Tool: The “Quote Tool” is an Excel-based workbook that allows an agency to take customer facts and generate a price. The tool (or workbook) generates both the estimate and the proposal. It also generate multiple financial views for billing and accounting. Access tip: Application here (quote tool)

Summary Document: Summary document illustrating our screening requirements. This is the foundation of our program and is required for underwriting by ever insured.

Phase 3: Bind Package

- Your assigned Business Advisor will create a Bind Package that will be sent to you to complete the bind process. You will be asked for a final version of the rated TIP National Application. Make sure all the information (data entry, elections, vehicle and driver information) is accurate and complete because all of the bind paperwork will be created from the workbook. The bind packet will contain the following documents for signature by the insured:

- Every Package will include the following:

-

- Proposal (PDF from Quote Tool)

- Fraud Warning Form

-

- TRIA Form

-

- Included as Applicable:

- UM-UIM Sel-Rej form

- PIP Sel-Rej Form

- INSEL Form (Check for Physical Damage Election)

- Surplus Lines Form

- Occupational Accident Enrollment Form

Phase 4: Invoice & Binder

Once the following documents have been returned to TIP national the Binder will be issued:

- Fully executed Bind Package

- Copy of the Premium Finance Agreement listing TIP National as an Interested Party

- Down Payments Transferred to TIP National

Phase 5: Claims Management

- Customer: All claims for Policies Bound BEFORE 07/01/2019 (Policy Prefix XNX-FINFR1705408) should be submitted directly to Triton Claims Management, LLC. Triton Claims information can be found HERE.

- Customer: All claims for Policies Bound ON or AFTER 07/01/2019 (Policy Prefix XNX-FINFR1905408) should be submitted directly to Lowers & Associates. Lowers Claims information can be found HERE.