With a long history in the transportation, freight, and final mile industries, ClearConnect Solutions Cofounder and President Scott Grandys witnessed first-hand an inevitable lack of transparency in the transportation insurance space. As mentioned in our April 2022 blog post, ClearConnect Solutions’ ClearTrac Technology Chosen for Lloyd’s Lab Cohort, Scott Grandys joined Cohort 8 of Lloyd’s Lab with an ambitious goal in mind – to further refine and test a new addition to the ClearConnect Solutions’ suite of products that would answer the call for better transparency and accuracy when it comes to scoring risk. Upon completion of the program, Scott and the ClearConnect Solutions team have spent the last six months refining the new product and preparing for its 2023 launch.

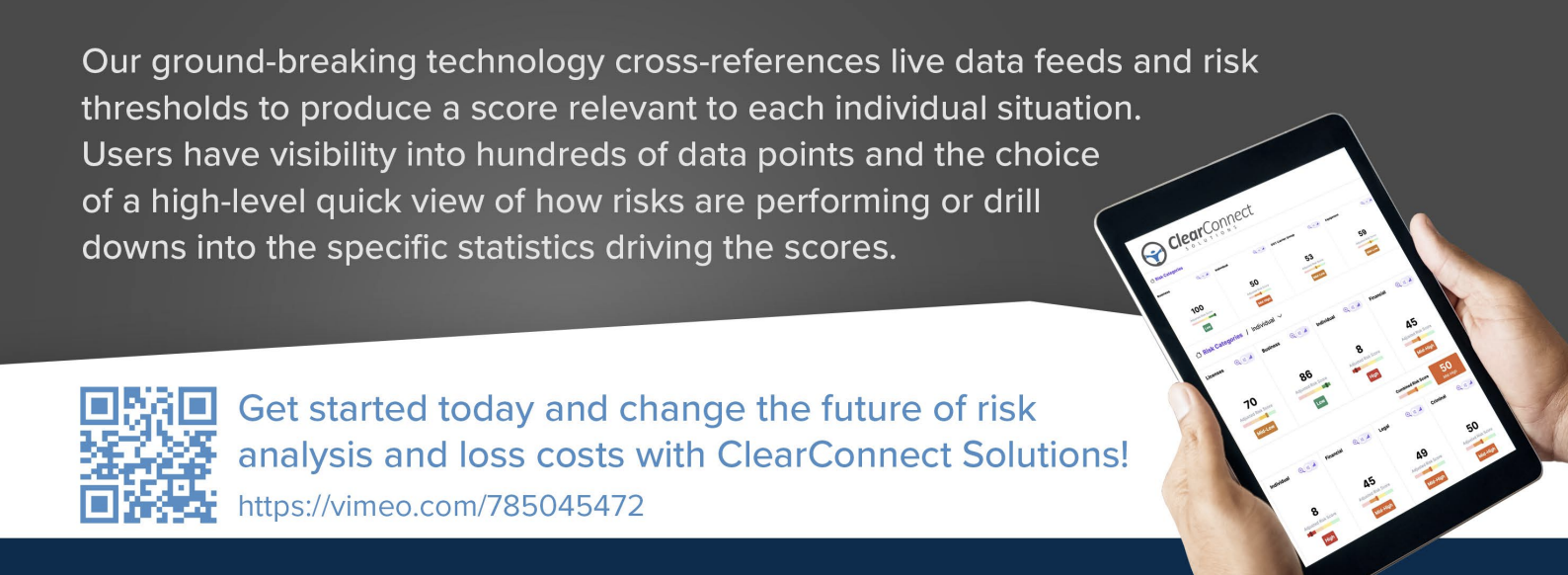

Risk-scoring in real time. Visibility into hundreds of quality data points. Cross-referencing live data feeds with risk thresholds. These are just a few of the solutions the new ClearConnect Solutions risk product will offer.

In a recent interview with Lloyd’s Lab, Scott Grandys elaborates on the ideation and development of his team’s new risk scoring tool.

“The Lloyds lab offered our team an opportunity to focus on a technology product that the industry didn’t know it needed. Now that they’ve seen what we’ve been working on, they can’t picture their future without it. Someday people will look back and say, “How was risk managed before ClearConnect?”

Scott notes the disconnect between those capitalizing on the risk in London and the coverholders, fleet owners, and drivers in the United States. Because of such, monitoring an insured’s risk in a meaningful way has been near impossible. Further, when underwriters in the U.S. have been tasked with assessing risk, the process is often lengthy, muddled, and overtly manual in a digital world. The resultant false insurance promises have led to an increasing number of shock claims and losses that exceeded the premium. Over time, this domino effect has created a negative connotation around the transportation insurance industry – a sector with the potential to be a thriving market.

Enter ClearConnect Solutions – whose mission is to answer these challenges with transparency, clean data points, and real-time visibility into risk scoring.

With a growing suite of products and services, ClearConnect Solutions presents the transportation insurance market an opportunity to recalibrate the risk scoring process – giving all stakeholders the ability to monitor risk with quality data in real-time. The result? A restored confidence in the insurance process from drivers and fleet owners all the way to cover-holders and underwriters.

Approaching its one-year anniversary with Lloyd’s Lab, ClearConnect Solutions prepares to offer the transportation market its risk-scoring tool. Lloyd’s Lab has not only created a nurturing environment for product development and testing, but has also helped establish credibility to pursue the work at hand and repair trust, transparency, and accuracy in the industry.

Stay tuned for news on our new product launch at clearconnectsolutions.com and on our socials.