How Does the Commercial Transportation Insurance Process Work?

Whether you’re an insurer, trucking company or underwriter, you most likely deal with at least one part of the commercial transportation insurance process.

But what does the whole process actually look like, and what happens at each step?

Today, we’ll walk through a typical process for requesting a new commercial fleet insurance policy.

Starting a New Insurance Policy

1. Request a policy (Insured/Trucking Company)

2. Shop multiple policies (Agent/Insurance Company/TPA)

3. Submit personal and vehicle records for risk evaluation (Insured/Trucking Company)

4. Establish the insured’s risk level and develop customized policy coverage (Underwriter/Agent/TPA)

5. Underwrite and bind/finalize policy (Underwriter/Agent/TPA)

6. Accept and approve policy (Insured/Trucking Company)

7. Conduct ongoing risk evaluation and mitigation (Insured/Trucking Company/Insurance Company)

Insurance, at its core, is pretty straightforward. But let’s take a closer look at how insurers and underwriters develop a policy to reach the right coverage at the right price.

Risk Assessment - How It Works

Before a policy can be bound, insurance companies must conduct an extensive risk assessment process to determine a driver’s prior, future and current risk level.

RISK ASSESSMENT – A risk assessment is a data-driven process that evaluates a client’s or driver’s risk level. It helps insurers make informed decisions on pricing, coverage, and risk management strategies.

In step #4, “Establish the insured’s risk level and develop customized policy coverage,” many trucking companies and insurers may rush this step in order to quickly finalize the policy. In other words, let’s finish the deal and get on the road!

But, in fact, this is by far the MOST IMPORTANT step. Evaluating and gathering driver and vehicle records and data like previous insurance claims, MVR’s (Motor Vehicle Records like traffic violations and crash reports), drug screenings and vehicle inspection reports – play a vital role in establishing an insured’s/trucking company’s risk level, liability coverage and final insurance policy and premium.

Data Analysis Technology - An Asset to Insuring Fleets

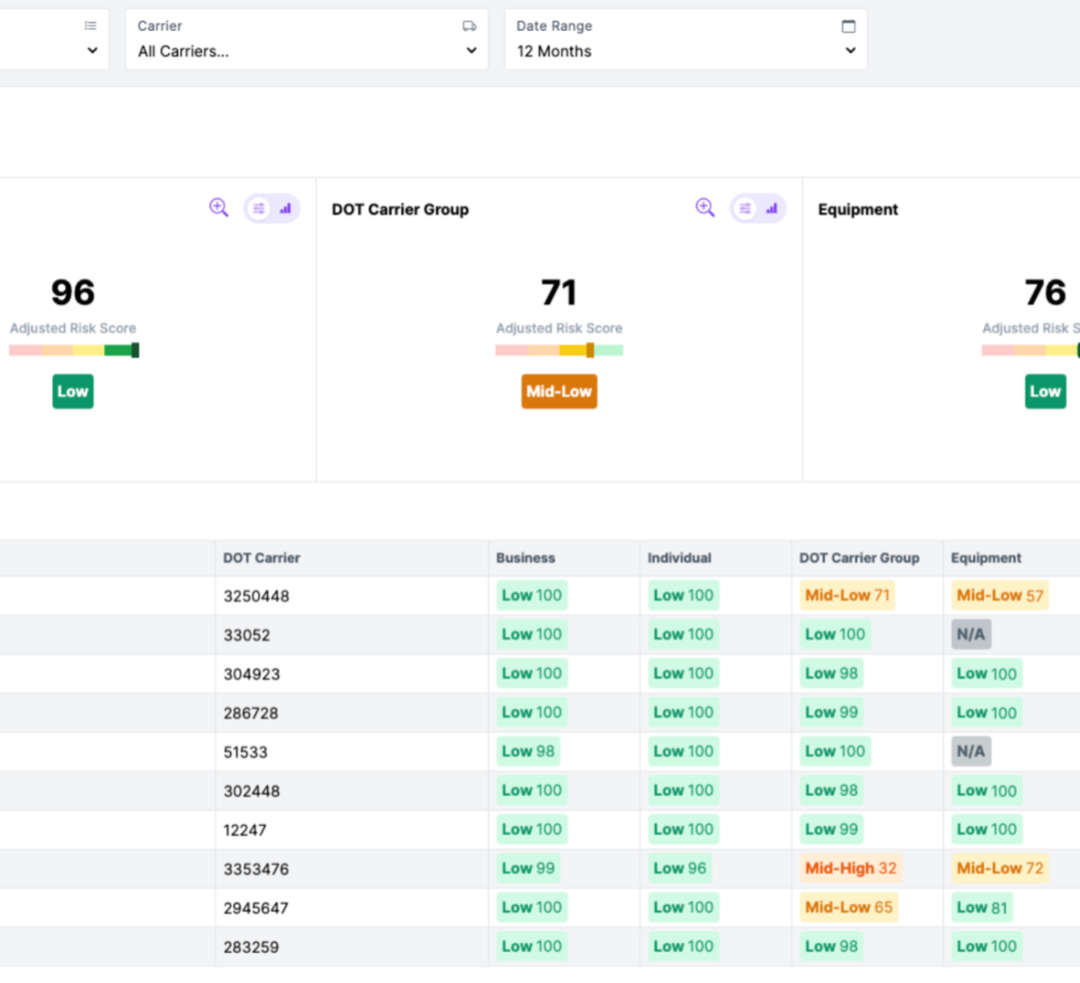

Using sophisticated technology like ClearConnect Solutions’ risk monitoring and scoring system can capture and analyze driver and vehicle data from multiple sources. Underwriters and trucking companies can access a highly comprehensive “view” of the driver’s risk level which is instrumental in evaluating driver risk and providing the most accurate policies.

Having the right data and the capability to monitor a driver’s risk level is the KEY to an informed insurance policy.

“The more fleet owners and drivers succeed, the safer the roads are, and more risk is lowered.” – Nick Rick, Product Specialist with ClearConnect Solutions

Stay tuned for the next Fleet Insurance 101 post: How Can Fleet Insurers Make Policies Better with Risk Mitigation?

And if you missed the first post, check it out here: Who Are the Key Players in Commercial Transportation Insurance, and What’s Their Primary Role and Responsibility?

If you’d like to LEARN MORE about ClearConnect Solutions’ fleet management and risk analysis technologies, contact us or schedule a product demo here.